Lithium Recycling from Black Mass - Should it be First or Last?

Lithium is the most essential element that goes into a lithium ion battery (LIB). It has the perfect properties for an electrochemical storage material; it is the lightest metal in the periodic table enabling light weight batteries which are required for both automotive and portable applications (think lead acid battery Vs a lithium ion battery). It has the most negative electrode potential (vs a standard hydrogen electrode) of any metal, allowing it to maximise cell voltage. It forms a single charge ion (Li+), avoiding complex chemistries and side reactions associated with ions of more than a single charge. It also has many other benefits which I will not list here.

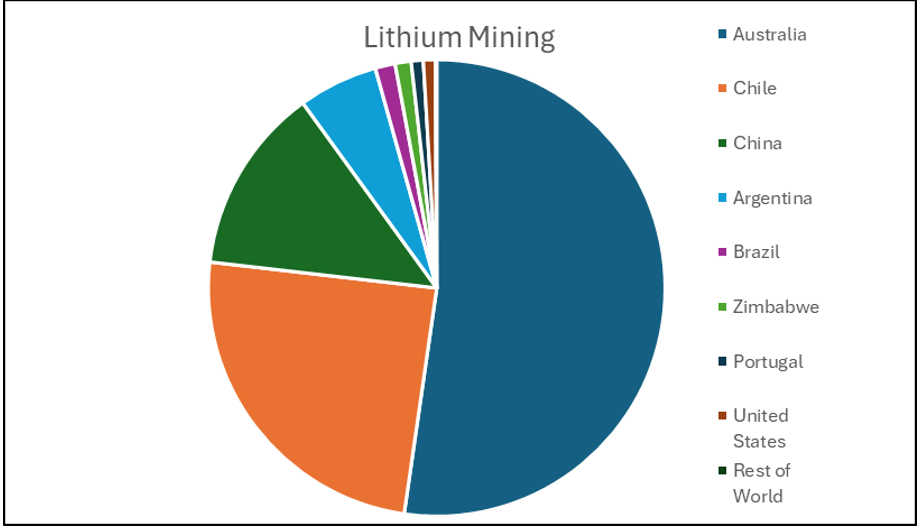

Making battery grade lithium is no easy feat. The majority of the lithium is mined in Australia and South America, but most of the refining is done in China which controls around 72% of the world’s refining capacity [1]. China is also the largest producer of lithium ion batteries and hence the largest consumer of lithium but it also exports thousands of tonnes of lithium ion batteries to all corners of the globe. This allows for the localised recycling and production of lithium providing that the locality has the technology to do so.

Chart showing where the world’s lithium came from in 2021 (data taken from World Economic Forum)

Battery Recycling

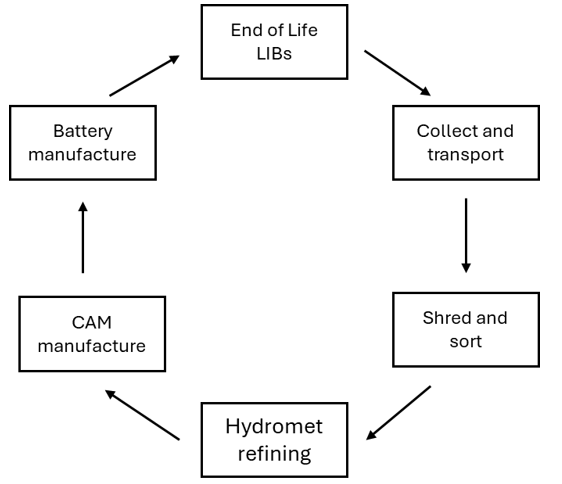

The battery recycling process is a five stage process. Stage one is the collection and transportation of the end of life batteries to a battery recycling facility. Stage two is the mechanical decommissioning of the batteries (shred and sort) to produce a number of products; copper, aluminium, steel and black mass – which is a mixture of the active powders that make the battery work (graphite and a lithium-transition-metal oxide such as lithium cobalt oxide). The third stage is the hydrometallurgical refining of the black mass to recover the valuable metals as well as the lithium in a salt form (such as nickel and cobalt hydroxides and lithium carbonate – these are known as precursor cathode active material or pCAM). Stage four is to use the recovered metal salts to produce cathode active material (CAM) and stag five is to use the CAM to make new cells that can be reintroduced into the market.

Being the most reactive and mobile metal within the battery, some of the lithium can be lost along the recycling process. For example, shredding plants that operate wet processes are likely to lose some of the lithium as it will react with the water. Some plants may use certain salts to improve the efficiency of the delamination process (taking the black mass off of the electrode foils) and these salts can interact with the lithium, making it more soluble and thus being lost in the water.

This focus of this article is on the hydrometallurgical recovery of the lithium. There are two competing processes – the first one is the standard route, which is that lithium is recovered last after all the other metals are recovered and the other is a lithium first route, where the lithium is the first metal to be recovered and the rest of the metals are recovered afterwards. As someone who has worked on and successfully developed (and patented) a lithium first process, I have my biases but I will try and keep these biases in check as I compare the two process routes. Lets start off with the standard lithium last route

Lithium Last Hydrometallurgical Route

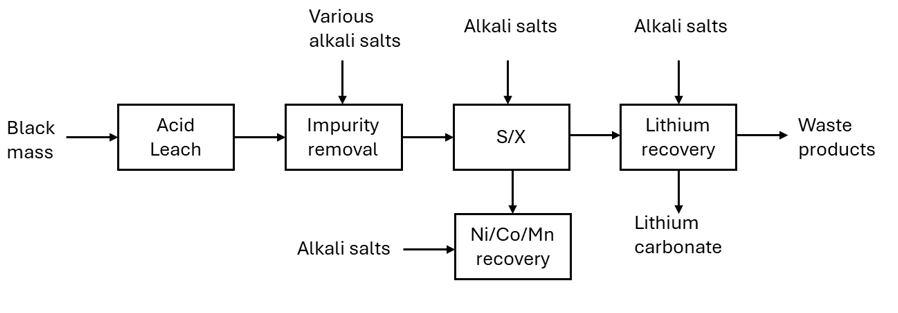

During hydrometallurgical processing, sulphuric acid is the standard acid used to dissolve black mass. More than 10 tonnes of (dilute) acid can be used for every tonne of black mass. Tonnes of various alkali metal salts (along with more water) are added to the pregnant leach solution (acid solution containing dissolved metal ions) to raise its pH, enabling the selective removal of different metals at different stages. Alkali metal salts are added to initially to increase the pH of the solution, they are then added to remove impurities such as aluminium and iron, more are added in the solvent exchange process to make the solvents have the right pH for extraction and finally, more alkali salts are added to recover the lithium. The added alkali metal salts all have similar properties to lithium salts and are all present in the solution when all the other cathodic metals (nickel, cobalt and manganese) are removed. When the lithium is precipitated out using sodium carbonate, some of these alkali metal salts also precipitate out with it and these act as impurities within the lithium, affecting its price. Standard hydrometallurgical processes can recover a technical grade (<99.5%) lithium carbonate that is not suitable for going back into the battery supply chain. The technical grade lithium carbonate must either be further upgraded, or it must be sold into the wider market where its price is heavily discounted against battery grade (>99.5%) lithium carbonate.

Lithium First Route

The lithium first route takes the opposite approach to the standard method as it recovers the lithium before any of the other metals are recovered. In normal conditions, the lithium in the CAM is in a non-reactive state as it is already attached to the other CAM components. Lithium, being very reactive, is easily activated through the use of heat or certain reducing reagents or a combination of the two. Depending upon the conditions and reagents used, the lithium can end up as an oxide or a carbonate. Both of these forms can be recovered with water as the oxide reacts with water to generate lithium hydroxide which is highly soluble and the carbonate is also soluble in water. Once dissolved into water, the lithium salts can be recovered through a simple filtration step.

The following companies are known to have developed lithium first processes

- Cylib Recycling

- Ascend Elements (announced they were building a plant capable of recovering 3000t/y of lithium carbonate, but it is not known if the plant was ever built) [3]

- ACE Green Recycling

- Smaller companies that are developing promising routes such as Battery Minerals

Advantages of Lithium Last Process

The major advantage of the lithium last process is that it does not require an additional plant that uses a different type of process (for example a thermochemical process) to recover the lithium. The same type of equipment that is used to recover the other metals are also used to recover the lithium. This makes it much easier to obtain the right type of permits, maintenance of the plant will be easier as will the training of staff.

Advantages of Lithium First Process

Lithium first processes have many potential advantages over the lithium last processes. Some of these are listed below:

- The first major advantage is that it can be deployed as a stand-alone process – without the need for a full-scale hydrometallurgical plant. This makes it very attractive for black mass producers who want to extract as much value from the black mass as possible.

- The next advantage is that it uses far less reagents to recover the lithium. In lithium last processes, tonnes of acid and alkalis are used before lithium recovery is possible. In lithium first processes, the reagent use is minimised

- Higher purity – as there are no alkali metal salts required for impurity removal or acid neutralisation, the purity of the lithium can be higher. In a previous employment, my team at Warwick Manufacturing Group were able to extract 99.8% pure lithium salts from mixed chemistry industrial black mass (supplied by RS Bruce, UK)

- The next advantage is that lithium first processes offer higher recovery efficiencies as lithium is lost in every stage of the hydrometallurgical process. The more steps there are until the lithium recovery, the more lithium is lost. In lithium first processes, the number of steps before the lithium is recovered are minimal so the availability of lithium for recovery is higher and in lab tests, up to 95% of the stoichiometric lithium in the black mass can be recovered. This figure will decrease somewhat as the processes are scaled up but it will still be far higher than the 80% offered by lithium last processes.

- Another advantage of the lithium first route is that it upgrades the black mass – depending on the mode used, the metals in the black mass can be reduced into base metals which are far easier to leach into acid and require far less reducing agents such as H2O2 to get them into solution.

- Finally, another big advantage for the lithium first process is that depending on the mode, it is possible to generate lithium hydroxide which is the lithium salt required for higher nickel content chemistries, such as all the latest NMC and NCA type chemistries. To achieve the same with the lithium last processes, you would require additional treatment in an electrochemical plant.

Disadvantages of the Lithium Last Route

The major disadvantages of the lithium last route are that the purity of the recovered lithium salt is low and therefore commands a much lower price than battery grade lithium salts – can be up to 33% lower. It cannot generate lithium hydroxide in one step and requires additional processing in another plant to generate it. To recover the lithium this way, you would need a full scale hydrometallurgical plant which costs hundreds of millions of dollars and are very expensive to operate. The lithium recovery efficiency for such plants is low because with each processing step, lithium is lost – for example, during the impurity removal step, the precipitated impurities are removed using a filter press (or a similar device) to form a filter cake. The cake will have a certain moisture content – say 40%, this moisture will contain all the metals that are present in the acid. Most of these can be washed out of the cake but some will still remain and the washing makes the lithium concentration more dilute and harder to recover.

Disadvantages of Lithium First Route

The main disadvantage of the lithium first route is that it relies heavily on the price of lithium salts. In many ways the lithium last route is also the same but as other metals are also recovered, the low price of lithium can be shielded by the (potentially) higher price of the other metals such as cobalt and nickel. Another disadvantage is that if lithium hydroxide is formed, it can react with aluminium impurities within the black mass which can act as an impurity within the lithium and requires further processing to remove it (which can be done in the same plant).

OK, so the big question now is, when does a lithium first plant become attractive? To answer this question, we need to understand that black mass producers are not paid for the lithium in the current market. In the future it may be the case but as things stand, black mass pricing is based solely on nickel and cobalt values. Therefore, it is in the interests of the black mass producers to recover the lithium themselves. So, the question becomes the following; at what price for lithium does lithium first recovery become compelling?

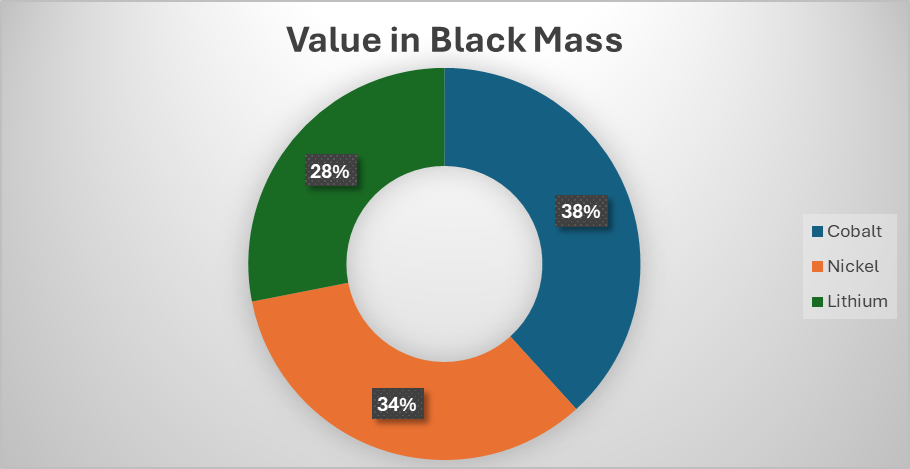

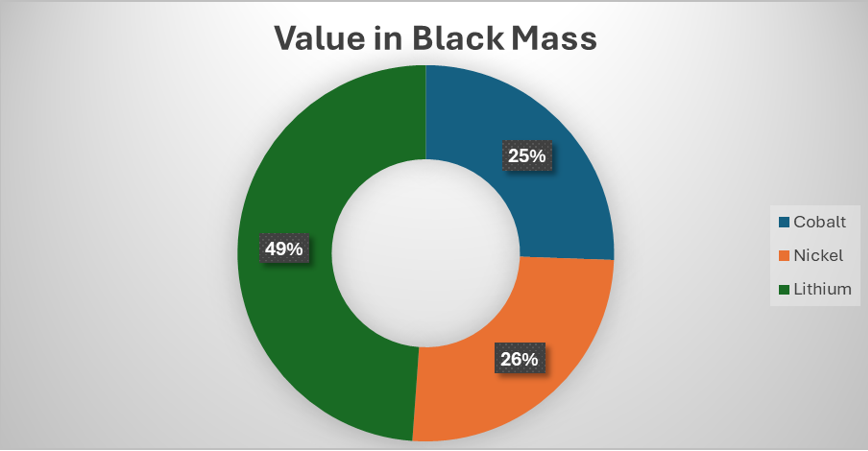

The answer to this question will be different for different but we can look at the proportion of the value that is attributed to lithium in a tonne of black mass and work from there. At the current price of cathodic metals (Ni = $15/kg, Co = $33/kg and Li = $53/kg), if we take an NMC 622 black mass with 58% CAM and 35% graphite (with the rest being impurities), the lithium accounts for only around 28% of the total value of the black mass or around £1,650 ($2,200).

It is well known that over the last couple of years, there has been an oversupply of lithium on the market and the price of battery grade lithium products has consistently been below the price of production. This is the result of the lumpy investment model that operates in the mining sector. When there is a 10,000-tonne deficit of a certain commodity, the price shoots up, prompting new mines to open up. However, when a new mine opens, it doesn’t just add 10,000 tonnes of metal onto the market, it adds many times more than that, crashing the price until the demand catches up with the supply (or less profitable, high cost operations close).

In China, the production of battery grade lithium carbonate is thought to be around $18-20/kg. If we take this figure and add a 20% profit margin to it, we get to around $24 or $25/kg. According to Fastmarkets [3], in 2026, there is likely to be a slight lithium deficit and so lithium prices will reflect this but new supply is available so it won’t overshoot like it did in 2022 (lithium carbonate price has already risen by around 30% in the last couple of months). If we take $25/kg as the long-term benchmark for lithium carbonate ($132/kg for lithium) and also increase the prices of nickel to $20/kg and cobalt to $40/kg. The proportion of the value of lithium in the black mass increases to a whopping 49% of the total value of the black mass or £5,160 per tonne ($8,900). All this value will be lost to the black mass producer…unless they can recover it themselves via a lithium first process.

I have not yet worked out how much it will cost to make such a plant, however a medium sized operation processing 10,000 tonnes of black mass will cost between £25-30 million ($33-$40 million). Such a plant will produce around 1600 tonnes (assuming 85% plant availability) of lithium carbonate annually (assuming 90% lithium recovery efficiency), with a value of £30 million ($40 million). At those prices, lithium first becomes extremely attractive. In comparison, a hydromet plant processing 10,000 tonnes of black mass per year will cost well over $100 million with enormous operating costs.

If you found this article insightful and are interested in lithium first recovery processes or if you’d like to see how SafeLi Recycling Ltd can help you increase profitability or solve a chemistry/engineering problem, please get in touch.